By Business Insider Reporter

Tanzania is positioning itself at the centre of East Africa’s digital finance transformation as it partners with Rwanda to pilot a regional instant payment system – a move that could redefine how money flows across borders and strengthen trade within the East African Community (EAC).

The Tanzania–Rwanda pilot, launched this week in Kigali, seeks to connect Tanzania’s Instant Payment System (TIPS) with Rwanda’s National Payment Switch (RSwitch), enabling individuals and businesses in both countries to send and receive money instantly between bank accounts and mobile wallets.

Once operational, the system will eliminate the delays, high costs, and inefficiencies that have long hampered cross-border payments, particularly for small traders and service providers operating within the EAC.

“This preparatory work marks a pivotal milestone in our regional payment integration agenda, moving us closer to a single regional instant payment ecosystem,” said Eng. Daniel Murenzi, the EAC’s Principal Information Technology Officer.

Representing Tanzania at the Kigali technical meeting, Fabian Ladislaus Kasole, Assistant Manager for Oversight and Policy at the Bank of Tanzania’s National Payments Directorate, reaffirmed the country’s commitment to digital financial inclusion:

“As a region, we remain committed to establishing a robust framework that ensures the successful interlinking of our national retail payment systems. This will enhance cross-border payment efficiency and financial inclusion.”

Strengthening Tanzania’s digital finance ambitions

The pilot aligns with Tanzania’s national ambition to deepen financial inclusion and modernise its payment ecosystem. Through TIPS – launched by the Bank of Tanzania in 2022 – the country has already enabled instant domestic transfers across banks, fintechs, and mobile money platforms such as M-Pesa, Tigo Pesa, and Airtel Money.

Linking TIPS with Rwanda’s RSwitch marks the next phase – turning Tanzania’s domestic success into a regional digital trade enabler.

“Tanzania’s leadership in this pilot puts it at the forefront of the EAC’s digital integration journey,” said a Dar es Salaam-based economist. “It will make cross-border trade faster, cheaper, and more transparent, benefiting informal traders, exporters, and even consumers.”

Real benefits for business and consumers

For Tanzanian traders operating between Mwanza, Kigali, and beyond, instant payments will remove one of the biggest barriers to regional trade – payment delays. Transactions that currently take days could soon be completed in seconds.

Lower transfer costs will also encourage more people to use formal financial systems instead of cash or informal transfer channels, expanding the reach of the digital economy.

For businesses, especially SMEs, this could mean improved cash flow and better regional competitiveness. “The ease of paying and getting paid instantly across borders is a game changer,” noted the economist. “It will make regional trade more inclusive, especially for small traders who can’t afford bank delays or cross-currency charges.”

Building the foundation for a regional digital market

The project is part of the EAC Cross-Border Payment System Masterplan, implemented under the Eastern Africa Regional Digital Integration Project (EARDIP) – a World Bank–funded initiative coordinated by the EAC Secretariat.

EARDIP aims to create a modern, secure, and harmonised payment ecosystem across East Africa by linking national systems, strengthening cybersecurity, and ensuring interoperability among banks, fintechs, and mobile money providers.

Crucially, the project will also harmonise policies and regulations to make cross-border digital payments legally sound and technically seamless.

“Digital integration is not just about technology,” said Eng. Murenzi. “It’s about building trust, harmonising rules, and ensuring that citizens and businesses can transact confidently across borders.”

A gateway to a borderless financial future

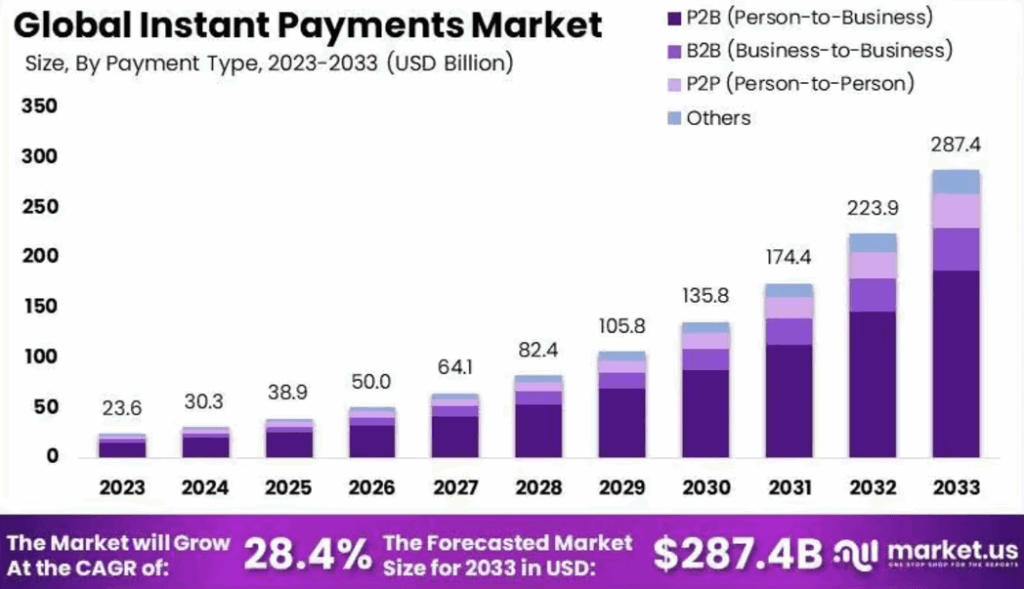

East Africa’s digital payment revolution is gathering pace. According to the African Development Bank, the region’s digital finance sector could exceed US$40 billion by 2030, driven by innovation and mobile connectivity.

By linking payment systems through TIPS, Tanzania is not only helping build a regional payment corridor but also strengthening its role as a digital financial hub. If the pilot succeeds, the system will expand to include Kenya, Uganda, Burundi, South Sudan, the DRC, and Somalia, creating a truly interconnected EAC payment market.