By Business Insider Reporter

Tanzania has been recognised as one of Africa’s leading countries in closing the financial inclusion gap, thanks to the rapid expansion of mobile money services and targeted regulatory reforms.

Speaking at the Africa Financial Inclusion Summit and Expo 2025 in Johannesburg on Thursday, Nazeem Hendricks, Senior Finance Specialist at South Africa’s National Treasury’s Jobs Fund, cited Tanzania and Kenya as standout examples of how digital platforms can transform access to finance across diverse populations.

“Platforms like Mpesa are changing the landscape. But success is not just about mobile technology, it’s about tailoring operations to fit the needs of each community,” said Hendricks.

In Tanzania, mobile money services such as Mpesa, Airtel Money, Mix by Yas, and Halopesa have brought millions of people – especially those in rural or low-income areas – into the formal financial system.

The platforms offer a wide range of services beyond money transfers, including bill payments, microloans and insurance, among other financial services.

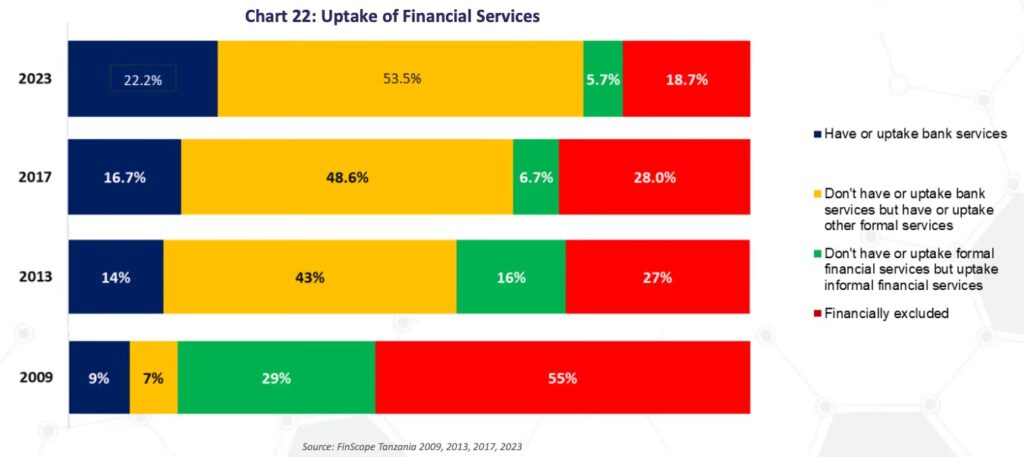

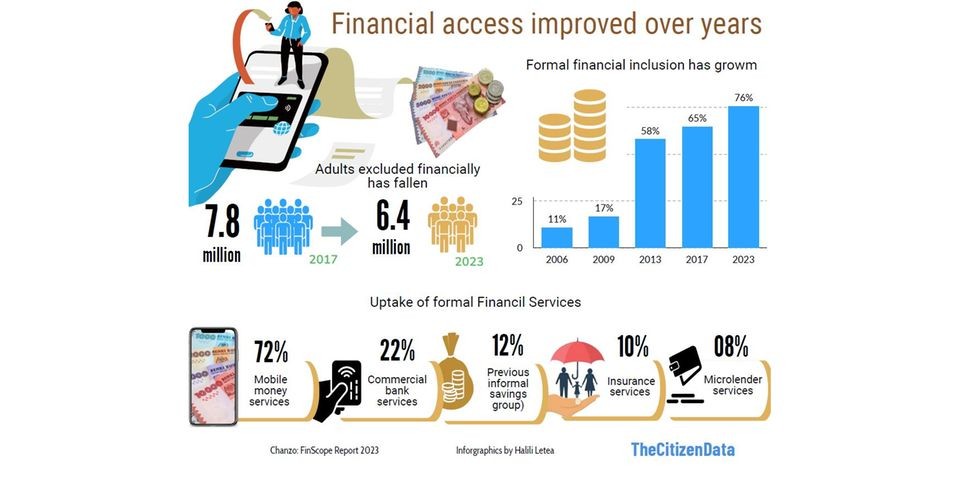

According to the Bank of Tanzania (BoT), the country has witnessed a sharp rise in financial inclusion over the past decade with the percentage of adults with access to formal financial services increasing from 16% in 2009 to 76.2% in 2023.

Now, over 42 million mobile money accounts are active and more than 3 billion mobile money transactions were processed in 2023, valued at TSh 140 trillion.

The country also has an extensive agent network, with over 80,000 agents serving customers across the country including ion remote areas.

Hendricks highlighted that successful financial inclusion strategies must also address infrastructure, digital literacy, and local capacity – particularly among youth.

“There’s a capacity challenge. In many areas, especially rural ones, young people don’t have the means – whether it’s access to phones, knowledge, or infrastructure – to fully engage with these platforms,” he said.

Tanzania’s government has supported this expansion through initiatives such as the National Financial Inclusion Framework (NFIF), which promotes access to digital services, financial literacy programs, and a favourable regulatory environment for fintechs.

“Our vision is to ensure that every Tanzanian, regardless of location or income level, has the opportunity to participate in the financial system,” said Dr. Natu El-maamry Mwamba, Permanent Secretary at the Ministry of Finance.

She added: “Financial inclusion is not just about banking the unbanked – it’s about creating tools that help people improve their lives.”

In addition to mobile money, Tanzania is also expanding access through agent banking, SACCOS (Savings and Credit Cooperative Societies) and community banks, which serve as critical alternatives for populations outside the reach of traditional financial institutions.

As African countries push for broader economic inclusion, Tanzania’s mobile-driven success story is being seen as a model for sustainable financial access across the continent.