- Tanzania sees 68% rise in dividends as Twiga, Airtel, NMB Bank dominate remittances to national coffers

By Business Insider Reporter

The government has reaffirmed its commitment to accelerating reforms aimed at strengthening state-owned enterprises (SOEs) and supporting companies in which it holds minority shares, to boost their contributions to the national socio-economic growth and development.

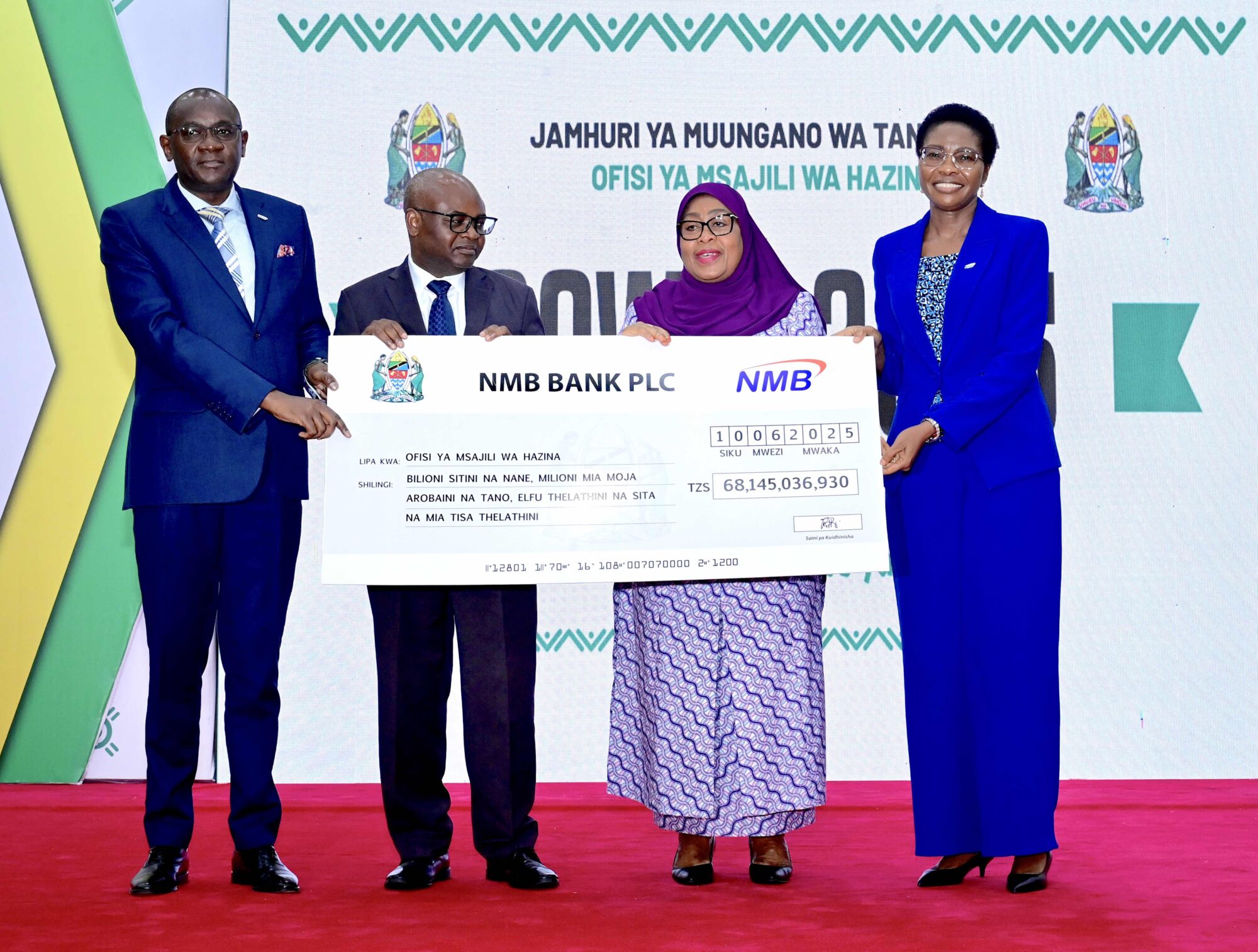

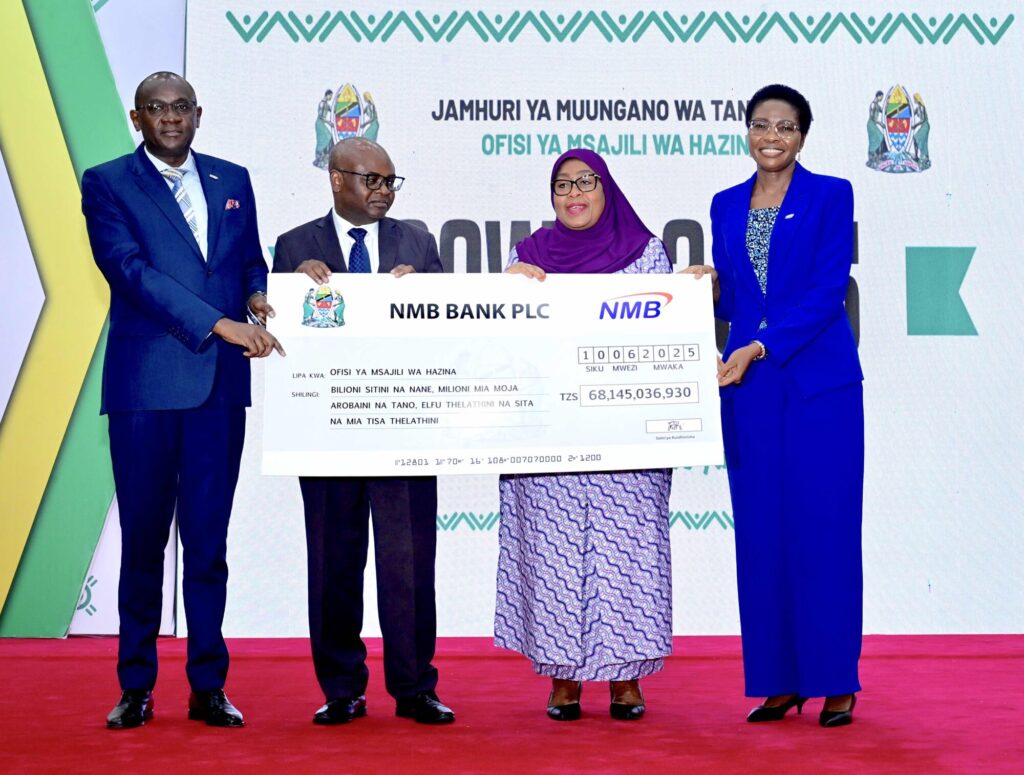

The pledge was made on Tuesday June 10, 2025 by President Dr Samia Suluhu Hassan at the second annual Dividend Day, held at State House, where she received dividend payouts and financial contributions from public and private entities in which the government holds shares, including top performer NMB Bank Plc.

This year’s dividend collections and other contributions that had reached TSh1.28 trillion by Monday, is a significant jump from the TSh767 billion collected throughout the entire previous financial year.

President Samia expressed optimism that the figure could rise further by the close of the 2024/25 fiscal year at the end of this month.

“This year’s increase is a clear indicator of the progress we’ve made in reforming SOEs and improving their impact on national development,” she stated, noting that public investment in these entities now stands at TSh86.29 trillion.

She also expressed confidence that enhanced operating conditions and better governance would yield even greater returns in the years ahead.

Dr. Samia specifically praised entities where the government is a minority shareholder, with NMB Bank among the top 10 entities with outstanding performance.

The bank was presented with a special award for remitting TSh68.1 billion – a notable rise from TSh54.5 billion last year.

To ensure continued progress, the President directed organizations to embrace new technologies, invest in human capital development, and directed fast-tracking of the new Public Investment Law, which aims to improve the efficiency and accountability of public investments.

Treasury Registrar, Nehemiah Mchechu, applauded NMB Bank’s consistent sectoral leadership, attributing its strong performance to robust revenue growth – reportedly increasing by over 300% in recent years.

The bank ranked third among the top 10 dividend contributors in the commercial category where the government holds less than 50% ownership.

Top contributors in this category included Twiga Minerals, which contributed TSh96.3 billion, up from TSh53.4 billion.

Airtel Tanzania followed with a contribution of TSh73.8 billion, an increase from TSh40.8 billion. NMB Bank contributed TSh68.1 billion, rising from TSh54.5 billion.

Puma Energy Tanzania contributed TSh13.5 billion, while the Tanzania Petroleum Development Corporation (TPDC) contributed TSh11.7 billion.

In his briefing to the President, Mr Mchechu emphasized that this year’s growth in dividend remittances reflects tangible progress in the government’s reform agenda.

“Only 145 entities submitted dividends last year. This year, that number has increased to 213 out of 309 – demonstrating stronger compliance, improved performance, and growing commitment to national development,” he said.

Mr. Mchechu also clarified that Dividend Day is not just about financial returns. “It’s a reflection of accountability, performance, and the willingness of public entities to align with the government’s reform vision.”

Last year, the first Dividend Day saw initial contributions of TSh611 billion, eventually rising to TSh67 billion by fiscal year-end.

This year, with TSh1.28 trillion collected as of June 9, the government is on track for another record-breaking close. The 2025 Dividend Day was attended by representatives from 309 public and public-private entities, where the government is invested either as a majority or minority shareholder.