By Business Insider Reporter

Iran’s decision to designate Kenya as its primary gateway to East Africa could have far-reaching consequences for the region’s trade flows, logistics networks, and geopolitical positioning – with both opportunities and competitive pressures for Tanzania and its other neighbours.

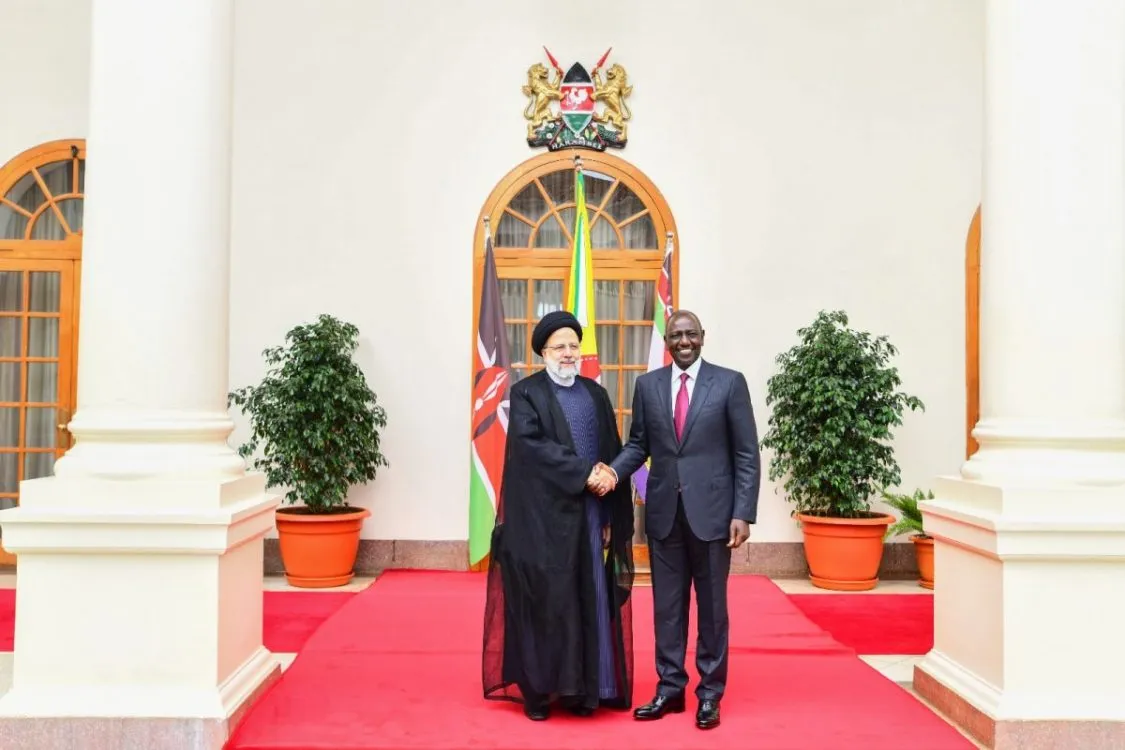

The move, announced by Iranian Agriculture Minister, Qolamreza Nouri Ghezeljeh, during a high-profile Nairobi visit with a 100-member trade delegation, signals Tehran’s intent to elevate bilateral trade with Kenya from “unsatisfactory” levels to a multi-billion-dollar relationship.

Shifting trade and logistics patterns

Kenya’s Mombasa Port – already the busiest in East Africa – will now serve as Iran’s main entry point for goods headed to a regional market of over 350 million people in the East African Community (EAC) and beyond.

This could divert some maritime trade and transshipment activities away from alternative hubs such as Tanzania’s Dar es Salaam Port.

Tanzania, which has invested heavily in expanding its port infrastructure and the Central Corridor railway to attract regional cargo, may face intensified competition for shipping lines and investors.

“If Iranian goods flood into East Africa through Mombasa, Dar es Salaam will need to strengthen its competitiveness by offering faster clearance, lower handling costs, and targeted trade incentives,” said a Dar-based logistics consultant.

Opportunities in secondary trade routes

Despite the competitive challenge, Iran’s Kenya-first approach could also benefit Tanzania.

With EAC markets interconnected, Iranian exports arriving in Kenya could transit through Tanzania to reach Rwanda, Burundi and the Democratic Republic of Congo via the Central Corridor railways which is currently being electrified.

Tanzanian transporters, warehousing operators, and border logistics services could see new business opportunities.

Moreover, Tanzania’s agricultural exporters – particularly tea, coffee, and spices – might gain indirect access to Iranian markets if re-export arrangements are developed through Nairobi.

But trade experts caution that this would require harmonising customs procedures and avoiding non-tariff barriers that currently slow intra-EAC commerce.

Impact on East African manufacturing, Supply chains

Iran’s strong capabilities in pharmaceuticals, industrial machinery, and agricultural technology could reshape East African supply chains.

Kenyan manufacturers might gain first-mover advantages through joint ventures and technology transfer agreements, potentially giving them a competitive edge in supplying the wider region, including Tanzania.

“This is where Tanzania must be proactive,” said a regional trade analyst in Arusha. “If Iran brings advanced agricultural technology into Kenya, Tanzania should negotiate parallel agreements to avoid being a downstream buyer of products made next door.”

Geopolitical and trade policy implications

Iran’s pivot to Kenya fits within its broader $10 billion Africa trade ambition, backed by investment funds, shipping lines, and air routes.

While Tanzania maintains diplomatic ties with Iran, it has not been as prominent in Tehran’s Africa engagement as Kenya. This could influence future foreign investment patterns, particularly in infrastructure, manufacturing, and agribusiness. The move also adds a geopolitical layer, as East Africa’s two largest ports – Mombasa and Dar es Salaam – vie for roles as continental gateways. Strategic positioning in regional trade blocs like the African Continental Free Trade Area (AfCFTA) will be crucial in determining which countries capture the most value from these shifting trade relationships.