By Peter Nyanje

Global trade enabler, DP World, has announced it has mobilised over US$1 billion in working capital to support businesses across emerging markets through its trade finance platform – marking a significant milestone with direct implications for Tanzania’s logistics and trade development.

This milestone achievement comes just four years after the launch of DP World Trade Finance, a platform designed to tackle the US$2.5 trillion global trade finance gap, particularly in underserved regions like East Africa.

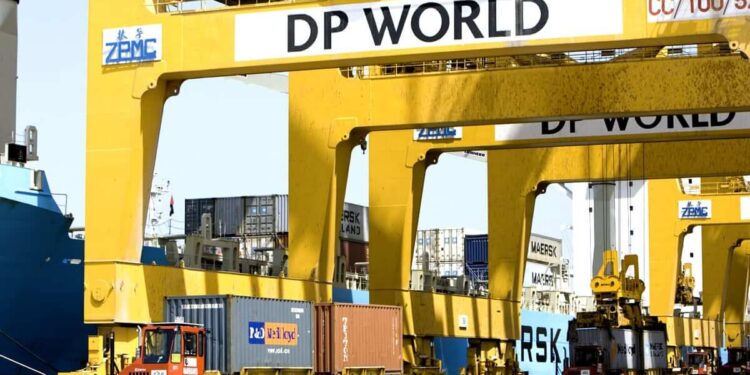

For Tanzania – where DP World operates major port logistics services, notably at the Dar es Salaam Port – this development signals a powerful push towards transforming the nation into a more competitive trade and investment destination.

“By making capital more accessible, particularly in high-potential markets, we are shaping a trade system that is more inclusive and resilient,” said Sultan Ahmed Bin Sulayem, Group Chairman and CEO of DP World in a statement. “This underscores the UAE’s role as a catalyst for global trade,” he noted.

Financing the flow of goods

In Tanzania, DP World’s operations at the Dar es Salaam Port, secured under a strategic public-private partnership, are already reshaping regional logistics.

Through infrastructure modernisation, digitised port operations, and integrated customs processes, the company is enabling faster and more reliable cargo clearance.

The addition of trade finance solutions now gives local and regional businesses access to short-term working capital – allowing exporters and importers to bridge cash flow gaps and better participate in international trade.

“Cross-border trade is the engine of global economic growth, but access to affordable finance remains a critical barrier for many businesses, especially SMEs in emerging markets. We’ve created a network that connects businesses with capital, streamlines the financing process, and enables trade to flow more consistently,” said Sinan Ozcan, Senior Executive Officer, DP World Trade Finance.

In Tanzania, where over 95% of businesses are SMEs, access to working capital is a persistent challenge.

Many are unable to meet trade documentation requirements, collateral thresholds, or banking conditions that traditional lenders demand.

Creating opportunities across East Africa

The trade finance facility also promises regional impact. As Tanzania serves as a transit hub for landlocked countries such as Zambia, Rwanda, Burundi, and eastern DRC, DP World’s integrated model – combining logistics, warehousing, customs clearance, and now financing – positions the country as a trade gateway.

Analysts suggest that DP World’s model could reduce turnaround times at ports and allow East African exporters to compete more effectively in global value chains for commodities such as coffee, tea, cotton, minerals, and manufactured goods.

Additionally, by working with 32 global financial institutions, including J.P. Morgan, Standard Bank, and NedBank, DP World is helping to de-risk lending to small and medium firms through data transparency, cargo tracking, and AI-driven credit profiling.

Trade facilitation

The Tanzanian government, under President Samia Suluhu Hassan, has championed trade facilitation as a pillar of its economic diplomacy and industrialisation drive.

The DP World finance platform aligns with national development goals, particularly in improving infrastructure financing, port efficiency, and access to credit for local enterprises.

“DP World’s trade finance offering is not just about moving goods – it’s about unlocking economic potential. Tanzanian businesses now have access to tools that were once out of reach,” noted a senior official at the Ministry of Investment, Industry, and Trade.

Empowering growth through integration

As DP World scales its logistics and trade finance offerings in Tanzania, the long-term impact could be transformative. More Tanzanian firms, particularly in agriculture, manufacturing, and mining, will gain entry into high-value markets.

Moreover, with increased capital flow, better supply chain visibility, and risk mitigation tools, Tanzanian exports stand to become more competitive, while foreign investors can operate with greater confidence.

This integrated model could serve as a blueprint for trade-led development across East Africa – where DP World already operates logistics corridors extending from Dar es Salaam to Kigali, Bujumbura, and beyond. With over $1 billion already disbursed globally and strong growth in Africa, DP World Trade Finance is not just closing a funding gap – it is reshaping the global trade finance map, with Tanzania at the centre of a more connected, prosperous future.