By Business Insider Reporter

Tanzania’s foreign direct investment (FDI) landscape is undergoing a notable recalibration in 2025, marked by a stronger tilt toward manufacturing and infrastructure-led projects and a deepening commercial relationship with Gulf economies. Data for July–September 2025 show the United Arab Emirates (UAE) emerging as Tanzania’s largest source of FDI for the quarter, underscoring a trend that is reshaping the country’s investment profile even as overall inflows soften.

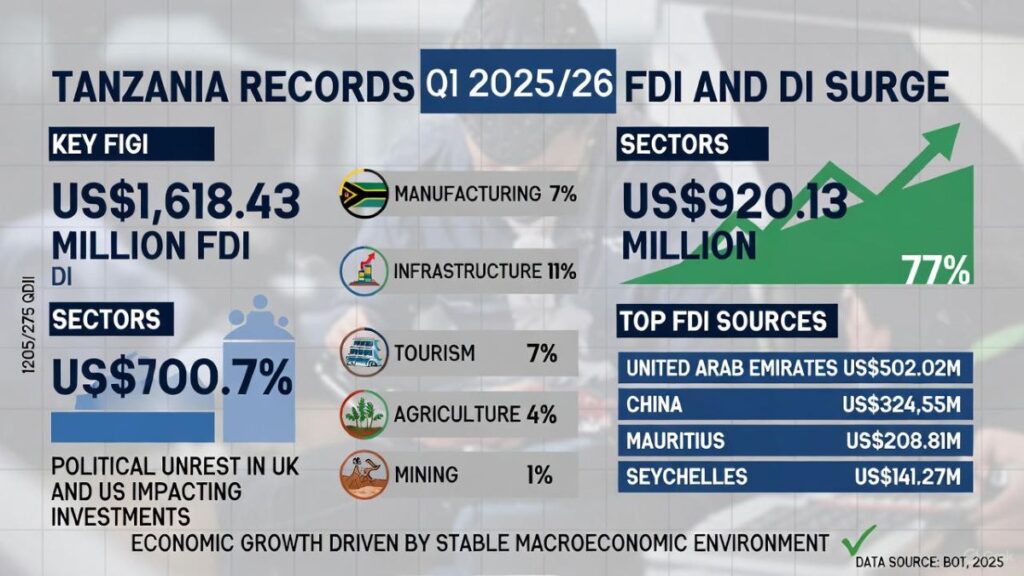

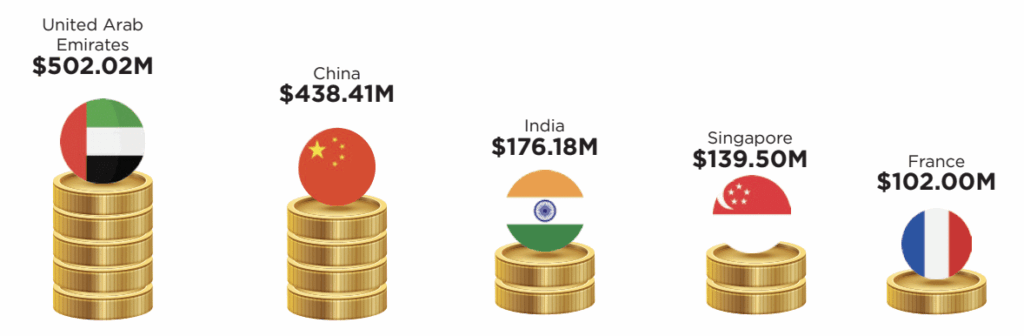

According to the Tanzania Investment and Special Economic Zones Authority (TISEZA), the UAE registered projects worth $502.02 million during the quarter, ahead of China at $438.41 million and India at US$176.18 million. Singapore and France completed the top five sources. Total FDI for the period reached $1.62 billion, down from $2.79 billion recorded in the same quarter a year earlier, reflecting a broader moderation in global capital flows amid tighter financial conditions.

While the headline figure points to a year-on-year decline, the composition of investment reveals a more structural story. Manufacturing absorbed the lion’s share of inflows at over US$1.1 billion, far outpacing economic infrastructure, energy, and commercial real estate.

This concentration suggests that investors are increasingly aligning with Tanzania’s industrialisation agenda, prioritising value addition, import substitution, and export-oriented production over purely extractive or speculative plays.

The impact is tangible. Manufacturing-led projects accounted for more than 7,700 of the 12,514 jobs expected to be created from investments registered in the quarter, reinforcing the sector’s role as a key employment engine. Infrastructure-related investments, including logistics and transport, are also expected to generate multiplier effects by lowering costs for businesses and improving connectivity to regional markets.

The UAE’s rise to the top of quarterly FDI rankings is particularly significant. Although it is not yet among Tanzania’s largest investors by cumulative stock, its growing presence reflects a strategic expansion of Gulf capital into East Africa, spanning manufacturing, logistics, real estate, and energy. This investment momentum is closely linked to trade ties: in 2024, the UAE ranked among Tanzania’s top five trading partners, accounting for 7.2 percent of exports and 10.6 percent of imports.

As supply chains reconfigure and Gulf investors seek stable, high-growth markets, Tanzania’s improving investment climate has become increasingly attractive.

Looking at the broader 2025 trend, Tanzania’s FDI performance has been characterised by volatility rather than collapse. While quarterly inflows have dipped compared with the exceptional highs of 2024, approvals remain anchored in productive sectors.

Investment promotion reforms, faster project facilitation through TISEZA, and ongoing infrastructure upgrades – such as ports, railways, and power generation – have helped sustain investor interest despite global headwinds.

Economists note that this shift could have longer-term benefits. A manufacturing-heavy FDI mix tends to deliver stronger spillovers in skills transfer, technology adoption, and export diversification than resource-led investment. If sustained, it could support Tanzania’s ambitions under its industrialisation and middle-income strategies, even if aggregate inflows fluctuate year to year.

However, the data also highlight policy challenges. The decline in total FDI underscores the need for continued reforms to crowd in capital, particularly in energy, agriculture, and services, where inflows remain relatively modest. Ensuring project implementation, not just registration, will be critical to translating investment commitments into growth and jobs. In sum, the UAE’s lead in Tanzania’s July–September FDI is less about a single quarter and more about a directional shift. As 2025 unfolds, the quality and sectoral focus of investment – rather than headline totals alone – may prove to be the more decisive factor shaping Tanzania’s economic trajectory.