By Business Insider Reporter

Tanzania’s insurance industry has recorded remarkable growth over the past five years, with the total gross written premium (GWP) nearly doubling from TSh 824.3 billion in 2020 to TSh 1.52 trillion in 2024, according to the latest report by the Tanzania Insurance Regulatory Authority (TIRA).

This represents an impressive 84 percent cumulative growth, underscoring the industry’s resilience and expanding role in the national economy.

Annual GWP rose steadily from TSh 911.5 billion in 2021, crossed the TSh 1 trillion mark in 2022, and reached TSh 1.24 trillion in 2023 before surging to the current record.

“The insurance sub-sector extended its decade-long expansion in 2024, delivering another strong outturn in gross written premiums,” notes TIRA’s Insurance Market Performance Report for 2024.

“Total GWP rose by 20.2 percent to TSh 1.52 trillion in 2024, from TSh 1.24 trillion in 2023. Over the last five years (2020–2024), the market sustained an average annual growth rate of 10.8 percent, confirming the steady deepening of insurance intermediation and its resilience through varying macroeconomic conditions.”

General insurance leads the market

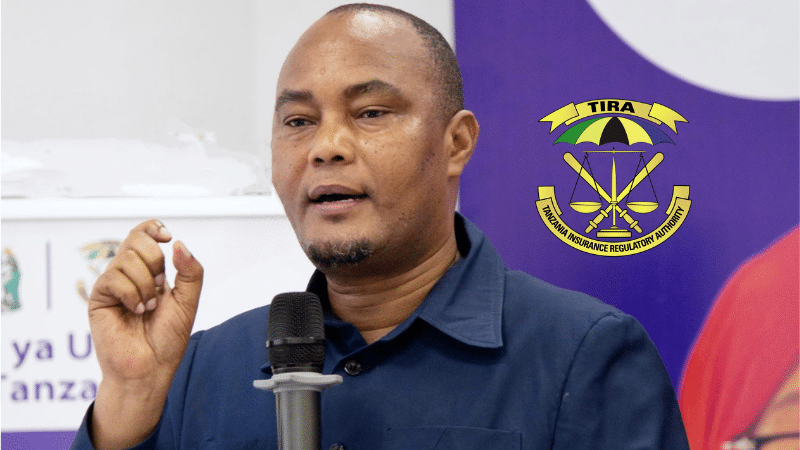

Presenting the findings in Dodoma recently, the Commissioner of Insurance, Dr. Baghayo Saqware, highlighted that general insurance remains the industry’s backbone.

The segment grew by 21.3 percent in 2024, with premium volumes rising from TSh 789.2 billion in 2023 to TSh 957.2 billion – accounting for 63.1 percent of the total market share.

Health insurance followed with a growth of 16.5 percent, expanding from TSh 161 billion to TSh 187.5 billion and representing 12.4 percent of total GWP.

Life insurance also performed strongly, increasing by 17.6 percent to TSh 309 billion from TSh 262.7 billion, capturing a 20.4 percent market share.

Takaful Insurance Gains Momentum

A standout performer was the Takaful segment, which posted an extraordinary 755 percent growth.

The Islamic insurance service expanded from TSh 500 million in 2023 to TSh 4.6 billion in 2024, marking its emergence as a viable alternative insurance model in Tanzania.

Zanzibar’s Chief Minister, Eng. Zena Said, commended the growth and called on TIRA to expedite the drafting of specific Takaful regulations to “enable better provisioning and oversight of the new insurance service”.

“Takaful, while still small, expanded sharply to reach 0.3% of total GWP – a clear signal of early traction for alternative insurance products,” Dr Saqware noted.

Reinsurance and external business on the rise

The external business segment – written by local reinsurers – also registered remarkable gains, more than doubling from TSh 27.3 billion to TSh 58 billion, representing 112.8 percent growth.

This lifted its market share to 3.8 percent, signaling improved regional competitiveness and growing confidence in Tanzania’s reinsurance capabilities.

A Growing pillar of the economy

Tanzania’s insurance industry continues to position itself as a key driver of financial inclusion and economic stability. The sustained expansion of premiums, coupled with diversification into health, life, and Takaful products, reflects growing consumer awareness and confidence in insurance as a financial safety net. With TIRA’s regulatory modernization and the sector’s digital transformation efforts underway, analysts project further gains in both penetration and innovation across the coming years.