By Business Insider Reporter

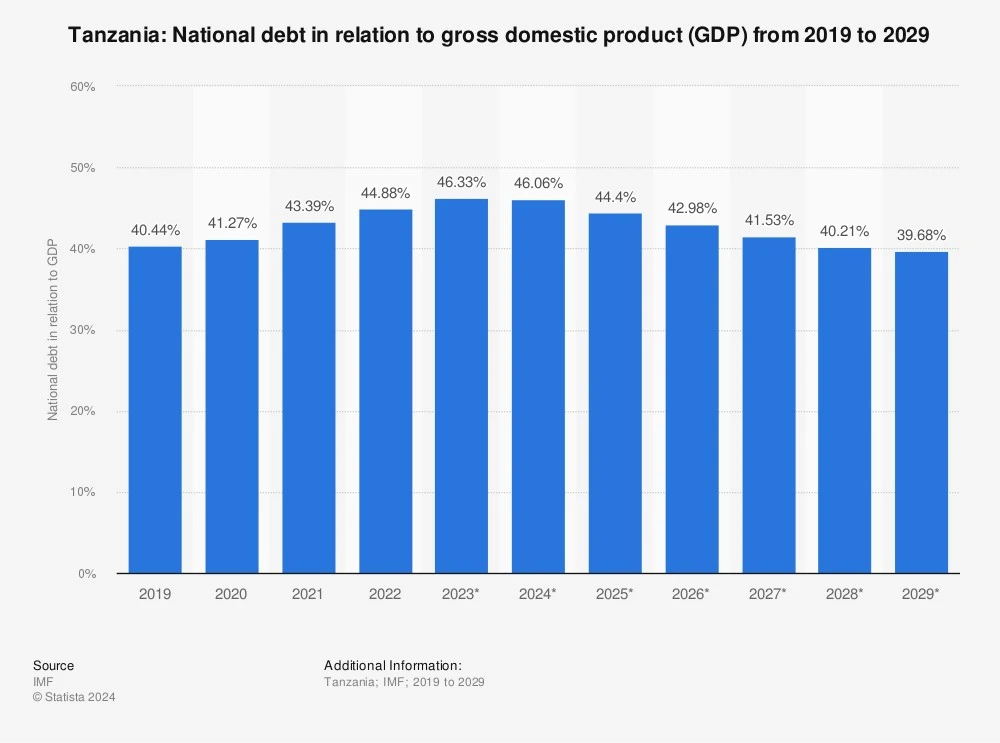

Tanzania’s national debt stock rose slightly to US$ 46.59 billion at the end of June 2025, marking a 1 percent increase from May, according to the latest Bank of Tanzania (BoT).

In its Monthly Economic Review (MER) for June, BoT notes that of this, 70.7 percent is external debt, underscoring the country’s reliance on international lenders to finance its development ambitions.

According to the MER, the external debt stock stood at US$ 32.96 billion, up just 0.1 percent from May.

Of this, the central government accounts for a dominant 85.4 percent, with the private sector’s share steadily shrinking.

During June, US$ 868.4 million in new external loans were disbursed – mostly to the government – while external debt service reached US$ 234.4 million, including US$ 173.6 million in principal repayments.

Multilateral institutions remain the largest creditors, holding 58.7 percent of Tanzania’s external debt, followed by commercial lenders at 34.8 percent.

By sector, transportation and telecommunications continue to absorb the biggest share of borrowed funds, signalling where the government is prioritising growth.

The US dollar dominates the currency composition, exposing Tanzania to exchange rate risks at a time when global markets remain volatile.

Domestic debt – driven by bonds

On the domestic front, debt climbed to TSh 35.5 trillion (about US$ 13.7 billion), a 0.9 percent increase over the month.

The rise was largely driven by the issuance of government securities, especially Treasury bonds, which now make up nearly 79 percent of the domestic portfolio.

Commercial banks, pension funds, and the Bank of Tanzania itself remain the biggest lenders to government, reflecting the strong role of domestic financial institutions in funding budget shortfalls.

In June alone, the government raised TSh 845.9 billion from the domestic market, while spending TSh 936.9 billion to service existing obligations.

Why it matters

The steady growth of debt is a double-edged sword. On one hand, it finances critical infrastructure – from ports and railways to energy projects – that lay the foundation for long-term economic expansion.

On the other, rising service costs put pressure on government revenues, potentially squeezing resources for social services like education and health.

According to one economist: “The challenge for Tanzania is not just about how much it borrows, but how effectively it uses those funds. Productive investments can transform debt into growth. But if borrowing goes to recurrent spending, repayment becomes harder and risks rise.”

With external debt increasingly concentrated in multilateral and commercial loans, analysts say Tanzania must carefully manage repayments while diversifying its revenue base. Efforts to strengthen exports, attract investment, and expand tax collection are all critical to ensuring debt sustainability.

For ordinary Tanzanians, these macro figures translate into the roads they travel, the electricity that powers their homes, and the schools their children attend – all financed, in part, by borrowed money. The debt story, then, is not just about billions of dollars owed; it’s about whether those billions build a stronger future.