By Costantine Muganyizi

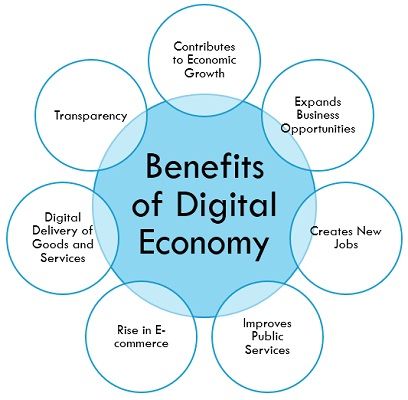

Africa’s networked market is on track to top US$1.5 trillion by 2030 – fueled by among other things bold reforms, smart infrastructure, and a generation of tech-savvy youthful consumers..

Trailblazers of this rapidly growing digital economy include Tanzania where government-led initiatives, private sector innovation, and widespread mobile connectivity are laying the groundwork for a more connected future.

Shehryar Bahk Ali, Mastercard’s Senior Vice President for East Africa and the Indian Ocean Islands, shared an optimistic outlook on Africa’s growing digital economy during the launch of two new smart payment cards by NMB Bank, designed to promote financial inclusion and improve access to digital financial services.

According to him, the continent’s digital shift is also being fueled by mobile connectivity, and progressive policy reforms. These elements are reshaping how individuals and businesses engage with financial systems, markets, and essential services.

“Digitization is already delivering substantial value to Africa’s development agenda,” Mr Ali said. “With mobile phones and fintech innovations now reaching every corner of society, countries like Tanzania are well-placed to lead this digital revolution.”

Tanzania’s Digital Momentum Tanzania’s own digital landscape has seen significant transformation in recent years. With over 67 million mobile connections – representing nearly 99% of the population – and more than 65 million mobile money accounts as of March 2025, digital access and finance has become deeply embedded in everyday life.

E-wallet transactions reached TSh1.1 trillion in the last quarter of 2024. Market leaders like M-Pesa, Mixx by Yas, and Airtel Money continue to drive growth, especially in rural areas where traditional banking infrastructure is limited.

At the May 7th event, NMB Bank unveiled two digital innovations: the NMB Virtual Card, which enables secure international payments through mobile phones, and the SME Business Debit Card, tailored for general enterprises.

“These products support the government’s vision of building a less cash economy,” said Mr Filbert Mponzi, NMB’s Chief of Retail Banking. “By empowering SMEs, we’re not only driving financial inclusion but also supporting the heartbeat of Tanzania’s economy,” he added.

Mr Ali emphasized the critical importance of empowering SMEs both digitally and financially, describing them as the lifeblood of African economies. SMEs represent over 90% of all businesses across the continent, create around 50% of all jobs, and contribute an average of 55% to Africa’s GDP.

According to Mr. Ali, targeted investment in digital tools and financial inclusion for these enterprises is not just a development strategy, but an economic imperative. By equipping SMEs with the resources and capabilities to scale and compete in the digital economy, African nations can unlock widespread innovation, reduce unemployment, and build more resilient, self-sustaining communities.

Digital Quest Challenges

He highlighted the role of banks and other financial institutions as critical enablers of African economic transformation, supporting the creation and expansion of digital infrastructure across sectors.

“Banks are not only providing financial services but are also at the forefront of building ecosystems that support mobile payments, digital commerce, and inclusive financial solutions,” Mr Ali explained, urging for more strategic partnerships in shaping the country’s digital future.

“Mastercard will contonue to partner with African governments and private sector players lie NMB Bank to support digital transformation efforts aimed at fostering financial inclusion and economic resilience.”

According to GSMA, the global lobby that represents the interests of mobile network operators and the broader mobile ecosystem, the digital economy in Africa has experienced significant growth and transformation in recent years, driven by technological advancements, increased internet penetration, and strategic investments.

“Tanzania’s digital economy is experiencing significant growth, driven by increased mobile connectivity, a surge in mobile money transactions, and strategic government initiatives,” Global Digital Insights notes in a recent report.

“However, challenges such as high internet costs, infrastructure gaps, limited rural connectivity, digital literacy gaps, and the need for stronger regulatory frameworks remains.

Vital Statistics

Apart from mobile connections and e-wallets growth, the digital finance and networked economy terrain in the country is additionally supported by the super information highway. .

Internet penetration stood at 31.9% in early 2024, with 21.82 million users. Mobile broadband dominates, comprising 99.6% of internet subscriptions, while fixed broadband remains limited.

According to the latest industry data, Tanzania’s mobile money sector continues its impressive growth trajectory. Regulator TCRA figures show that in the first three months of 2025 alone, 1.3 million new mobile accounts were added, rising from 64.3 million in January to 65.7 million in March.

Industry experts attribute the growth to increased smartphone penetration, user-friendly digital platforms, and growing trust in mobile financial services.

The market is led by M-Pesa, which boasts over 26 million users, followed by Mixx by Yas with 20.2 million, and Airtel Money, which accounts for 12.1 million. These platforms offer a wide range of services, including peer-to-peer transfers, utility payments, savings tools, and micro-lending options.

Mobile money transaction volumes have also surged. In 2024, Tanzanians conducted 10.3 billion transactions, compared to 3.8 billion in 2020 — a staggering 172% increase in just four years.

Digital Economy Blueprint

Analysts say the rapid adoption of mobile money is reshaping Tanzania’s economy, especially in rural areas where traditional banking infrastructure remains limited.

“Mobile money is no longer just a convenience — it’s a vital tool for economic participation,” said one fintech analyst. “It’s helping millions of Tanzanians

In 2024, the government launched the Tanzania Digital Economy Strategic Framework 2024–2034, a comprehensive blueprint designed to modernize infrastructure, expand broadband access, foster innovation, and enhance cybersecurity.

Unveiling the strategy, President Samia Suluhu Hassan described it as a “guiding light” for building an inclusive, resilient, and globally competitive digital economy.

“This framework signifies our firm commitment to the future and serves as a guiding light as we endeavor to build an inclusive, resilient, and competitive digital economy,” she stated.

Outlook: A Digital Powerhouse in the Making

Despite the challenges, momentum continues to build. With a young and tech-savvy population, rapidly expanding mobile usage, and a growing number of strategic partnerships, Tanzania is well-positioned to lead Africa’s digital transformation.

Industry analysts and investors are watching closely, as the country accelerates efforts to become not just a participant but a key architect of the continent’s digital future.

“Tanzania’s digital potential is enormous,” said a local fintech analyst. “The pieces are coming together — now it’s about sustaining the pace and ensuring that no one is left behind.”

According to consulting firm Tanzania Investment and Consultant Group Ltd (TICGL) of Dar es Salaam, growth of the national digital economy will be fueled by strategic investments and smart partnerships.

“Addressing challenges related to affordability and infrastructure will be crucial to realizing the full potential of the national digital economy and ensuring inclusive development,” notes the company in a recent analysis.