By Peter Nyanje

Tanzanian government is in advanced discussions with several global energy firms to launch its long-anticipated LNG project.

Notable names include Equinor of Norway, Shell, ExxonMobil, and Pavilion Energy.

These discussions center around a large-scale LNG export terminal in the southern Lindi Region, but experts suggest there is growing interest in parallel small-scale LNG solutions to meet domestic demand and support off-grid electrification.

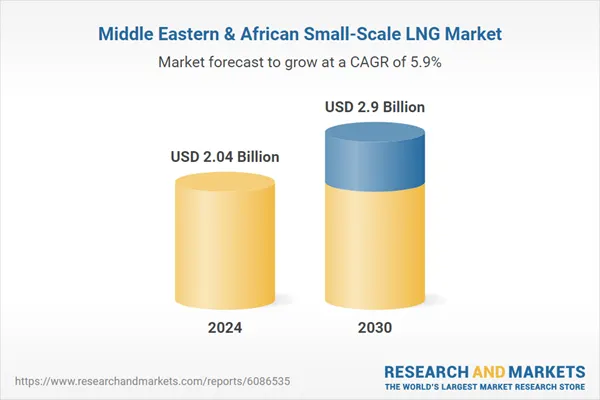

As the Middle East and Africa’s small-scale liquefied natural gas (LNG) market projects a robust growth trajectory – set to expand from US$2.04 billion in 2024 to US$2.90 billion by 2030 – Tanzania finds itself uniquely positioned to benefit from this energy transition.

With significant natural gas reserves and a growing demand for cleaner, decentralised power solutions, the country could emerge as a pivotal player in the region’s energy transformation.

Tanzania’s natural gas endowment, estimated at over 57 trillion cubic feet, provides a solid foundation for domestic and export-oriented LNG developments.

While large-scale LNG infrastructure remains capital intensive and time-consuming to implement, small-scale LNG presents a nimble and scalable alternative, particularly suited for addressing rural electrification, industrial fuel switching, and clean transport challenges across the country.

According to the latest report by Research and Markets, one of the key drivers of the small-scale LNG market is the growing regional demand for clean energy, especially in off-grid and remote communities.

This mirrors Tanzania’s own development needs. With over 60% of the population still lacking access to grid electricity in rural areas, small-scale LNG could become a practical solution to accelerate the country’s electrification targets under initiatives such as the Rural Energy Agency (REA) program.

Moreover, the environmental appeal of LNG, which emits significantly fewer carbon emissions compared to diesel or heavy fuel oil, supports Tanzania’s climate commitments under the Paris Agreement.

As the country continues to develop its Nationally Determined Contributions (NDCs), integrating LNG into its energy mix could serve as a strategic transition toward a lower-carbon economy without compromising energy access or industrial growth.

Power generation is one of the most promising applications for small-scale LNG in Tanzania.

With hydropower generation vulnerable to climate variability and grid expansion progressing slowly, the country can leverage modular LNG-based systems to deliver reliable electricity to underserved regions.

Such systems could be deployed near industrial parks, mining zones, or even island communities, providing them with cleaner and more stable energy sources.

The flexible and scalable nature of small-scale LNG infrastructure also complements Tanzania’s industrialisation agenda under the Tanzania Development Vision 2030.

For industries dependent on imported and polluting fuels, LNG could serve as a locally sourced, cleaner-burning alternative, thus improving energy security while reducing operational costs and emissions.

On the transportation front, small-scale LNG opens the door for Tanzania to develop clean fuel corridors for heavy-duty trucks and buses, especially along strategic trade routes such as the Central Corridor.

Establishing LNG refueling stations could attract logistics companies looking to cut fuel costs and meet environmental standards, offering Tanzania a first-mover advantage in East Africa.

Nonetheless, capital investment and infrastructure costs remain a challenge. Developing small-scale LNG supply chains – ranging from liquefaction and storage to transportation and regasification – requires considerable upfront funding.

Tanzania will need to foster a conducive policy environment that encourages public-private partnerships, concessional financing, and international support to realise these ambitions.

Learning from regional peers such as Egypt and South Africa, which have already started deploying small-scale LNG projects, Tanzania could fast-track pilot initiatives in targeted locations.

These could act as proof-of-concept models to attract broader investments and demonstrate the viability of LNG solutions in the Tanzanian context.

Furthermore, integrating small-scale LNG into Tanzania’s energy planning will require coordinated policymaking across ministries of energy, environment, finance, and transport. Streamlining regulatory frameworks and ensuring transparent licensing procedures can create a predictable investment climate that aligns with regional energy trends.

The presence of major international players in the Middle East and Africa – such as Royal Dutch Shell, TotalEnergies, Chevron, BP, and Eni – underscores the strategic importance of LNG in the global energy landscape.

These firms, already active in upstream gas developments in Tanzania and currently some of them discussing with Tanzania on the development of a large LNG project, could be instrumental in scaling down operations to suit local needs through joint ventures or technology transfer initiatives.

In conclusion, as the small-scale LNG market gains momentum across the Middle East and Africa, Tanzania stands to benefit significantly by aligning its natural gas strategy with emerging regional trends. With the right mix of investment, infrastructure, and policy support, the country can turn its gas reserves into a catalyst for inclusive energy access, industrial growth, and environmental sustainability.