By Business Insider Reporter

The global gold market in 2025 experienced extraordinary momentum.

With a record annual average price of about US$3,431 per ounce and quarterly averages briefly pushing above US$4,000/oz, the year marked one of the strongest rallies for gold in decades.

This boom has been fueled by heavy central bank purchases, robust exchange-traded fund (ETF) demand, safe-haven flows amid geopolitical uncertainty, and a softer US dollar – with many forecasts pointing to continued firmness into 2026.

Tanzania: From mineral wealth to economic catalyst

For Tanzania, already firmly positioned among Africa’s top gold producers, the upswing has amplified the sector’s macroeconomic importance.

Minerals Minister Anthony Mavunde highlighted the strong performance of mineral exports in early 2025, noting that the sector achieved historic earnings of roughly US$4.1 billion, with gold contributing the largest share.

He attributed this to a combination of expanded production, effective sector management, and strong global demand.

Bank of Tanzania (BoT) data throughout 2025 reinforce this picture:

Gold export receipts surged 35.5 percent year-on-year to about US$4.32 billion in the year ending August 2025, up from US$3.19 billion.

By late 2025, receipts were trending toward US$4.6–4.7 billion for the full year.

The latest Monetary Policy Statement shows US$2.6 billion in gold exports in the first half of FY2025/26, up from US$1.93 billion in the comparable 2024 period.

Exports of goods and services

“During the first half of 2025/26, exports of goods and services amounted to US$ 10,002.8 million, increasing by 6.7 percent from $9,376.6 million in the corresponding period in 2024,” the central bank notes in the new MPS published late last week.

“This performance was mainly driven by an increase in exports of gold, tourism, manufactured goods, and traditional exports, particularly tobacco, cashewnuts, and coffee.”

It adds: “Goods exports were US$ 5,988.7 million, while services receipts amounted to US$ 4,014.1 million. Gold and travel services remained the dominant export earners, together contributing 47.7 percent of total goods and services exports.”

Central Bank’s View: Windfalls and stability

The BoT has explicitly linked gold’s rally to stronger macroeconomic stability.

In September 2025, the central bank reported that rising prices – near US$3,368/oz at the time – and safe-haven demand significantly lifted export proceeds.

BoT Governor Emmanuel Tutuba later emphasised that elevated inflows from gold, tourism, and cash crops improved foreign exchange liquidity, helping stabilize the shilling and lift reserves to about US$6.7 billion, equivalent to more than five months of import cover.

Current account and external balance

Gold has also helped narrow Tanzania’s current account deficit.

“The external sector continued to improve, with the current account deficit narrowing progressively, estimated to reach a five-year low of 2.2 percent of GDP in 2025,” BoT notes in the February 2026 MPS.

In levels, the deficit is estimated to be US$ 609.7 million, during the first half of 2025/26 compared with US$ 657.5 million recorded in the corresponding period in 2024/25.

“The improvement was on account of a significant increase in exports of gold, tourism, and transport. The lower oil prices in the world market also contributed to the narrowing of the current account,” it adds.

The current account position is expected to continue improving gradually on the back of the efforts to enhance tourism and goods exports, along with favourable global gold prices.

How gold prices translate to local gains

While Tanzania is a producer rather than a producer of finished bullion products, the price boom benefits the economy through multiple channels:

1. Higher export revenues & FX strength

Gold’s elevated price directly increases the value of exports even when production remains relatively stable. Tanzania’s gold sector has seen both production growth and improved export earnings, pointing to strong integration with the global price environment.

This surge in export receipts enhances foreign exchange earnings, allowing the Bank of Tanzania to support monetary stability and build reserves – key for import cover and macroeconomic confidence.

2. Spillovers into fiscal resources

Government revenue from mining royalties, taxes, and lease payments grows with higher export values. This expands fiscal space, potentially enabling greater public investment in infrastructure, social services, and economic diversification.

3. Strengthening investment climate

High global gold prices attract foreign investment in exploration and mining operations. Investors are more likely to commit capital where returns are robust – boosting jobs, local supplier linkages, and technological transfer.

However, the degree to which Tanzanians benefit depends on regulatory frameworks, local content policies, and revenue management tools that ensure export gains are shared across communities.

Balancing rewards and risks

While the upside has been clear, there are nuanced considerations for sustained benefit:

Dependence on global commodity cycles:

Heavy reliance on a single commodity exposes the economy to price volatility. A softening in gold prices or a rapid reversal could dampen export growth and forex receipts.

Distribution of gains

Ensuring that mining communities and downstream local industries capture value remains a policy imperative.

Fiscal and monetary policy calibration:

Managing windfalls without overheating the economy or creating distortions requires disciplined frameworks.

Gold’s strategic role

While challenges around sustainability and equitable distribution persist, the 2025 gold boom underscores the strategic value of natural resources – turning global market dynamics into real national advantage. With careful policy stewardship, Tanzania’s experience in 2025 could become a blueprint for leveraging commodity strength into broader economic transformation.

Gold Boom: What it means for Tanzania’s economy

1. Foreign exchange and balance of payments

- The jump in gold exports has significantly improved foreign exchange inflows, buttressing the balance of payments and narrowing persistent external deficits. Strong export earnings have helped Tanzania cover import needs comfortably and maintain stronger reserves.

2. Fiscal space and public investment

- Higher export earnings translate into larger tax and royalty bases. These have the potential to expand fiscal space for infrastructure, education, and health investments, especially if revenue-management frameworks remain disciplined and transparent.

3. Downstream opportunities

- Particularly notable is the government’s focus on strengthening local gold refining capacity and integrating mining value chains — moves that could elevate job creation, domestic value capture, and technology transfer.

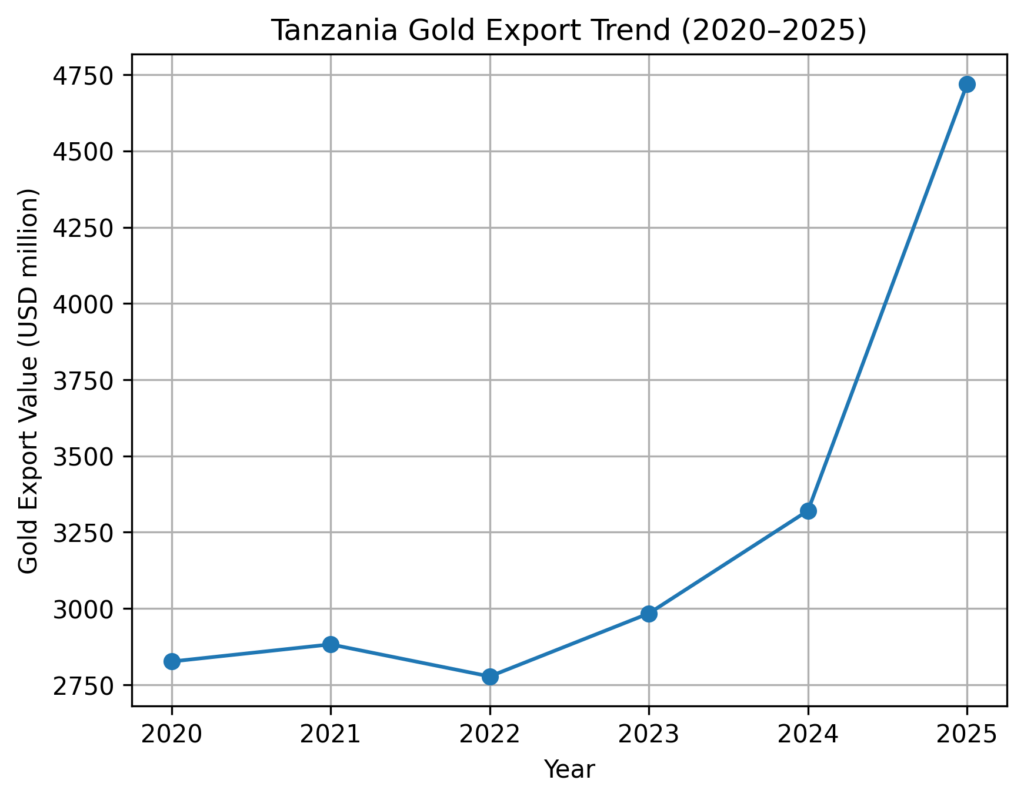

Turning a global rally into national gains The 2025 gold rally has created a rare alignment between global markets and domestic policy. Export values rising from about US$2.8 billion in 2020 to nearly US$4.7 billion in 2025 show how strategic market engagement can deliver major gains. With sound policies and macroeconomic discipline, gold can continue to support growth and stability into 2026 and beyond.