By Business Insider Reporter

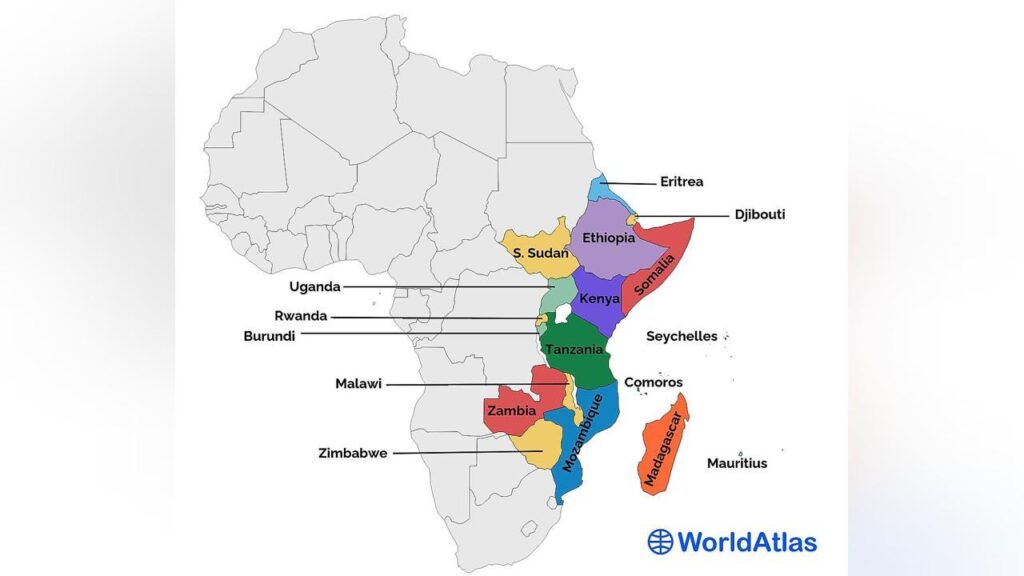

East Africa has cemented its position as the fastest-growing region on the continent, outpacing West, Southern, Central and North Africa in real GDP growth, fiscal prudence and relative debt sustainability, according to the African Trade and Economic Outlook 2025 published by the African Export-Import Bank (Afreximbank).

While the continent overall is projected to grow by 4.0% in 2025, East Africa is already ahead of the curve, posting an average growth rate of 4.4% in 2024, up from 4.1% in 2023.

This regional performance is being driven by countries such as Rwanda (8.6%) and Ethiopia (6.6%), with Tanzania and Uganda also registering above-average growth.

East Africa leads in recovery and stability

Unlike other regions, East Africa avoided recession even during the height of the COVID-19 pandemic in 2020. The subregion’s growth trajectory has remained consistently strong from 2021 through 2024, averaging 4.4% over the period.

In contrast:

- West Africa grew at 3.6% in 2023, improving to 4.1% in 2024.

- Southern Africa lagged with only 2.2% growth in 2024, hindered largely by South Africa’s underperformance.

- North Africa declined to 3.2% in 2024, dragged down by instability in Libya and sluggish activity in Algeria.

- Central Africa showed moderate performance but continues to depend heavily on oil exports for growth.

This regional divergence underscores East Africa’s resilience, bolstered by a combination of domestic reforms, infrastructure investments, and expanding intra-African trade ties.

Modest gains in inflation and fiscal discipline

Inflation remains a challenge across Africa, but East Africa has shown signs of stabilisation, with inflation dipping slightly from 21.2% in 2023 to 20.9% in 2024. While this figure remains high, it contrasts favourably with Southern Africa, where inflation plummeted from 38.9% to 20.1%, and West Africa, where inflation rose from 20.6% to 21.4%.

The region also performed well on fiscal management, with deficits narrowing in Burundi, Ethiopia, and Kenya, helping to reduce the average fiscal deficit in the region. The subregion’s public debt-to-GDP ratio dropped significantly – from a stable 60% between 2020 and 2023 to 52.2% in 2024, despite Sudan’s extreme outlier debt level (354.3%).

This performance places East Africa among the most fiscally disciplined regions on the continent, alongside Central Africa, which saw its debt-to-GDP ratio fall to 38.7%.

Trade and current account pressures persist

Despite strong GDP growth, East Africa’s external position remains a concern. The region recorded a current account deficit of 4.2% of GDP in 2024, one of the highest on the continent, slightly improved from 4.5% in 2023. This reflects persistent import dependence and narrow export baskets, particularly in landlocked economies.

Rwanda and Burundi are among the worst performers in terms of current account deficits, with projections of 12.2% and 17.3% of GDP, respectively. However, Djibouti bucked the trend, posting a current account surplus of 5.4%, likely due to its status as a logistics hub in the Horn of Africa.

The broader East African region, particularly Kenya, Tanzania, and Ethiopia, continues to rely heavily on imported intermediate goods and machinery to sustain infrastructure and industrialisation projects, thus pressuring the trade balance.

Debt Management and Creditworthiness

On the sovereign credit front, Tanzania emerged among six African countries to receive a credit rating upgrade in 2024, according to Afreximbank, reflecting improved macroeconomic stability and better debt management. The region benefited from broader African gains in market access, with a resumption of Eurobond issuances.

Comparative Snapshot: Africa’s Regional Performance, 2024

| Region | Real GDP Growth | Inflation (%) | Public Debt (% GDP) | Fiscal Deficit (% GDP) | Current Account (% GDP) |

| East Africa | 4.4% | 20.9% | 52.2% | Moderate (declining) | -4.2% |

| West Africa | 4.1% | 21.4% | 51.1% | 4.5% | -0.2% |

| Southern Africa | 2.2% | 20.1% | 71.0% | Mixed | -2.3% |

| Central Africa | ~3.5% | 8.4% | 38.7% | Near balanced | -1.9% |

| North Africa | 3.2% | 18.5% | 77.7% | 9.0% | -3.4% |

Policy Priorities for East Africa

To sustain its growth lead and close structural gaps, East African governments are being urged to:

- Expand local manufacturing capacity to reduce import dependence;

- Strengthen trade logistics and port infrastructure, especially for landlocked economies;

- Accelerate AfCFTA implementation, especially in trade facilitation and rules of origin;

- Deepen financial sector reforms to expand private sector participation.

The report also highlights the need for climate-resilient infrastructure, given recurrent droughts and floods in the region that threaten agriculture and food security.

East Africa’s performance stands out as a beacon of economic promise in a continent navigating global turbulence, geopolitical tensions, and climate shocks. However, resilience must now translate into transformation – through export diversification, industrialisation, and debt-risk mitigation.

As Afreximbank’s chief economist Dr. Yemi Kale puts it, “The region’s growth is no accident. It reflects difficult reforms, sustained investments, and a vision for structural transformation. The challenge now is staying the course.”