By Business Insider Reporter

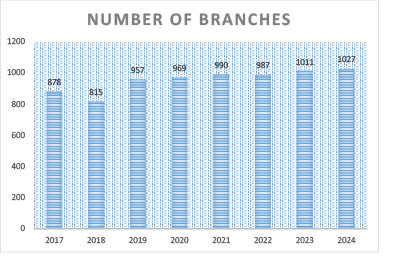

Despite a steady increase in the number of bank branches across the country in recent years, their distribution remains heavily skewed — a challenge to the nation’s broader financial inclusion agenda.

Official statistics show that between 2017 and last year, the number of brick-and-mortar bank outlets in the country grew by 26%, which the Bank of Tanzania (BoT) says signifies a significant rise in the usage of banking services.

As of 2024, the country had a total of 1,027 bank branches, up from 1,011 in 2023, signaling a positive trend in banking access and service adoption. However, a closer look at the regional data reveals deep inequalities in access to formal banking services.

Dar es Salaam tops the list with a staggering 278 branches, followed distantly by Mwanza (72), Arusha (70), Kilimanjaro (50), and Dodoma (48). Meanwhile, Katavi Region sits at the bottom with just 6 bank branches, raising concerns about equitable access to banking services in rural and remote areas.

“Bank branches increased to 1,027 in 2024 from 1,011 reported in 2023. This growth reflects a rise in the usage of banking services,” noted Mr Sadati Musa, the Director of Financial Sector Supervision at the Bank of Tanzania, in a recent interview.

Sectoral figures show that as of April 2025 CRDB Bank Plc was the dominant player in the local market with 260 branches followed by NMB Bank, whose total added up to 241 after the opening of two new outlets in Dar es Salaam’s fastest growing suburbs of Chanika and Kinyerezi in March.

Next on the list are Tanzania Commercial Bank (TCB) with 82 branches, NBC (National Bank of Commerce) – 61 branches – and then Diamond Trust Bank Tanzania that has 29. Stanbic Bank Tanzania, the third most profitable lender, which plans to open its first branch in Zanzibar this year, has 11 branches.

“Banking services in Tanzania are offered through various delivery channels which include branches, agent banking and digital banking services. The number and usage of these channels has been increasing steadily which enhance financial inclusion,” notes the central bank in a recent report.

“Branch network is dominated by large banks which accounted for 55.2% and concentration in urban centres accounted for 51.6% of total branches,” reads the latest edition of BoT’s Financial Sector Supervision Annual Report.

Speaking at the event to open the NMB Kinyerezi Branch, Vice President Philip Mpango lauded the lender for being at the forefront in supporting the Sixth Phase Government’s agenda of expanding inclusive financial services closer to the people.

“According to the 2023 Finscope Report, only 22% of Tanzanians use formal banking services. These two new branches will help people in Chanika, Kinyerezi and surrounding areas access formal financial systems,:” noted NMB Bank’s CEO Ruth Zaipuna.

“With 34 branches in Dar es Salaam and 241 nationwide, we’ve grown significantly since 1997, when we only had 97 branches. The branches are supported by 722 ATMs, over 50,000 agents, and digital services like NMB Mkononi,” she added.

According to financial analysts, the lack of branch presence in underserved regions like Katavi, Rukwa, and Simiyu could hinder efforts to bring more Tanzanians — especially those in rural communities — into the formal financial system.

“This disparity highlights the urgent need for targeted interventions,” said an economist from the Financial Sector Deepening Trust (FSDT Tanzania). “If we are serious about achieving the goals of the National Financial Inclusion Framework, then infrastructure development in marginalized regions must be prioritized.”

Efforts to address these gaps may rely more heavily on digital banking, mobile money platforms, and agent banking, which have seen significant uptake in recent years.

However, physical bank branches still play a critical role in on-boarding new customers, offering advisory services, and building trust — particularly in areas where digital literacy remains low.

As Tanzania pushes towards its 2026 financial inclusion targets, ensuring a more balanced distribution of banking infrastructure will be key to unlocking economic potential across all corners of the country.ial inclusion